At the May 12 Council meeting, Council approved the 2025 Tax Rate Bylaw, which included budget amendments to account for mandatory provincial requisitions and formal approval of the 4.8 per cent municipal property tax increase that was originally set by Council during the budget process last November.

This means a typical single-family residential property assessed at $670,500 will pay about $97.16 per year more in taxes than the previous year. This change works out to be approximately $8 more per month for the municipal property tax portion only.

“The Town is facing the same cost pressures as residents when we are purchasing goods, completing construction projects and delivering services,” said CAO Elaine Vincent. “The increase in the municipal taxes we are collecting allows us to continue providing the high-quality services our community relies on despite rising costs."

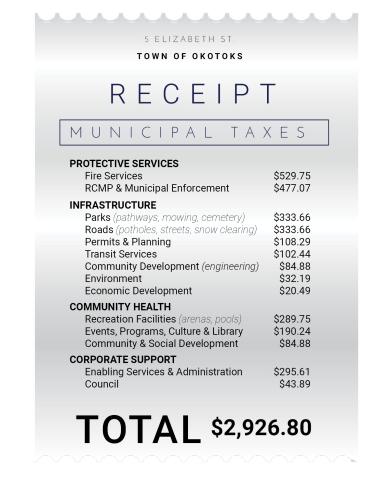

Breakdown of property taxes for an average single-family home in Okotoks with an assessed value of $670,500:

| Municipal Property Tax | ~$99/year increase |

| Provincial Education Requisition (collected on behalf of the province) | ~$270/year increase |

| Westwinds Communities (seniors and supportive living) | ~$2/year increase |

Property Tax Notices

- Property Tax Notices are being sent to all taxable property owners in late May 2025, with tax payments due by June 30, 2025.

- Please contact the Town through our online form or at 403-938-8919 if you have not received your tax notice by June 2, 2025.

- Property owners may also apply for Tax Installment Payment Program (TIPPS) for convenient monthly payments at okotoks.ca/TIPP.

Property owners are encouraged to use the Town’s Property Tax Estimator at okotoks.ca/tax-estimator. This tool will show where tax dollars go, based on individual property assessments.

Learn more about tax rates and requisitions by visiting okotoks.ca/taxes.

_0.png)