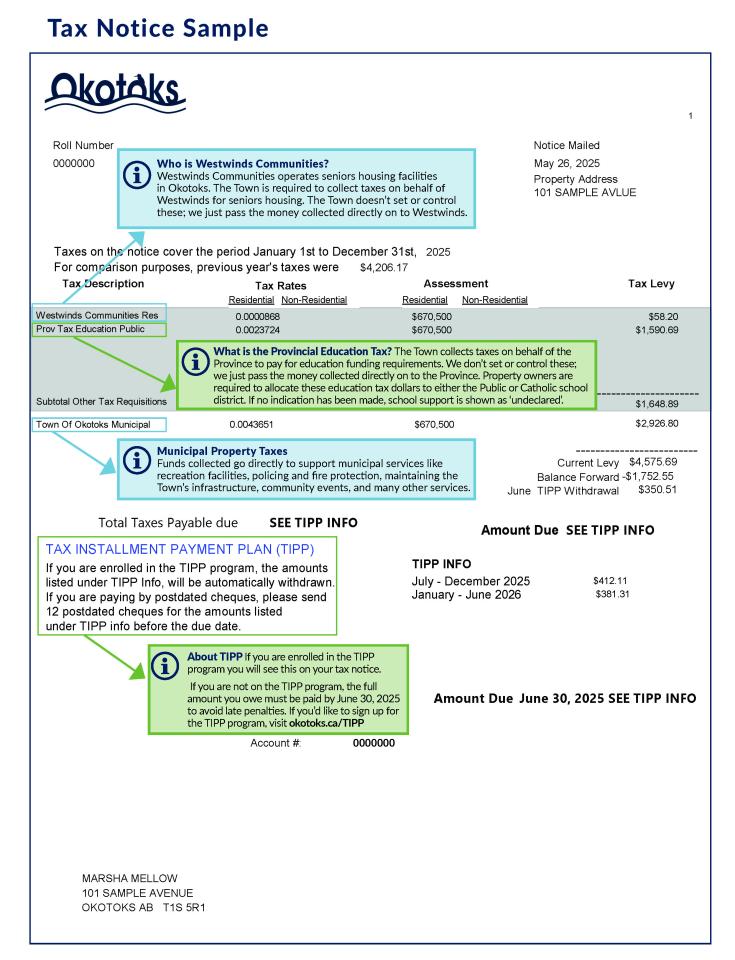

2025 Town Tax Notices were mailed on May 21 and emailed by May 27 2025. All assessed property owners are now deemed to have received their Tax Notice. Property owners who have not received their property tax bill by June 4, should contact our Tax Administrator through our online form, or call 403-938-8919 to request a copy.

Please pay your 2025 property taxes in full, on or before June 30, to avoid the late penalty charge. Joining the monthly Tax Installment Payment Plan (TIPP) must be completed by June 23 to avoid the late penalty.

Ways to pay your property taxes:

- TIPP (Tax Installment Payment Plan)

- By mail*

- 24-hour drop-off box

- In person

- At local banks, credit unions or any TD Canada Trust

- Online through banks/credit unions

Important to note:

- Payment must be received by the Town on or before the payment due date of June 30, 2025.

- When paying through a financial institution, please be aware this method of payment may require 5 to 7 business days for processing.

- *Even in the event of mail delays or interruption, it’s your responsibility to make sure payments are made on-time through one of the other available payment methods.