1. What is property assessment based on?

Property assessment is based on a market value standard estimated as of July 1 of the previous year, as measured by the real estate marketplace according to property sales in the area.

Assessment applies similar criteria that real estate appraisers use when valuing properties for mortgage lending purposes and pricing properties for sale. Data considered includes:

- Style (bungalow, two story, bi-level, etc.)

- Lot characteristics

- Size

- Building

- Age

- Garage

- Amenities

2. What is the objective and purpose of property assessment?

The objective is to provide a basis for distribution, or allocation, of taxes required to operate the Town and pay the Province for education funding requirements. The purpose is not to reflect one sale price, but to assess all similar property at a similar value so that taxation is fairly and uniformly distributed among all taxable property.

3. Market Value Assessment Standard

Assessed market value is calculated by incorporating legislative provisions that utilize mass appraisal principles. Mass appraisal is the process of valuing groups of properties. Market value standards mean the median assessment in each group is on the median purchase price.

4. Why is the assessment valuation date last July?

This is a provincial statutory requirement that allows all assessors to annually analyze and evaluate market and sales data and prepare values prior to mailing assessment notices. All properties are assessed with the same effective date so all assessments are updated at the same time.

5. Why use a market value standard?

The market value standard is a legislated and regulated valuation standard based on the premise that the amount of tax a property can pay is directly proportionate to the value it is worth. Market value standard generates values that can be objectively and readily compared for fairness to open market sales activity.

6. How is the assessment system an open and accountable process?

The assessment roll is available for anyone's review and values are posted on the Town website. The assessment roll is submitted every year to the Province for independent review and audit. Owners can see and compare assessments in addition to right of appeal. Property characteristics compared against other properties that have sold in order to calculate a value. Characteristics such as location, age, size and others are considered.

7. Why are assessment valuations prepared on an annual basis?

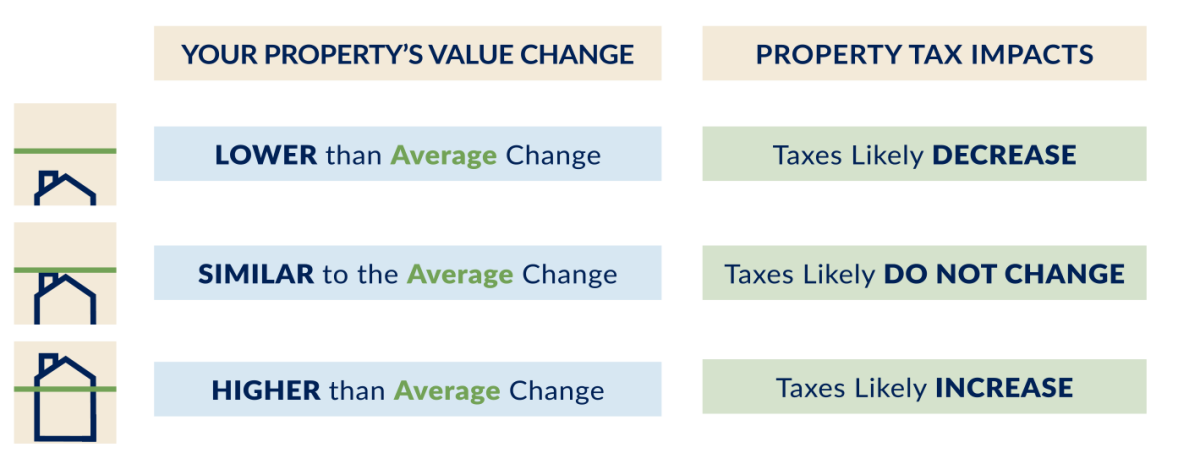

To quickly reflect shifting values relative to the norm, or each other. To ensure no given property type or area is penalized with assessments too high when its value may have dropped, or not have increased to the extent of other properties. Property tax levies are always adjusted to municipal revenue requirements.

8. If reassessments are not a means for generating more tax revenue why are properties valued so frequently?

The intent of reassessing properties is to retain the competitive placement of each property in the community hierarchy. Reassessment reflects differing value change rates and ensures all properties are retaining their fair respective slice of the entire Town assessment pie.

9. How much accuracy is there to assessed values?

Assessed values should not be viewed as an absolute number. Real estate valuation is based on market observations and comparisons. The market is an imperfect environment and not a controlled structured setting.

There is a range in price purchasers will offer and a range that sellers will accept. So there is a transaction zone for every property transaction. Differing property types will have varying tolerances to an actual deal. In addition, to ranges inherent to individual deals, assessed values are generated on a mass basis which indicates precision to assessed values is less than 100%.

Provincial Audit standards require that the Average Assessment within a competitive group is to be within 5% either higher or lower than the average sale price within that group, and the range within a set of comparable sale properties can well exceed 10%. Generally Assessment Complaint tribunals will not consider adjusting an assessment where the request is for anything less than 5%.

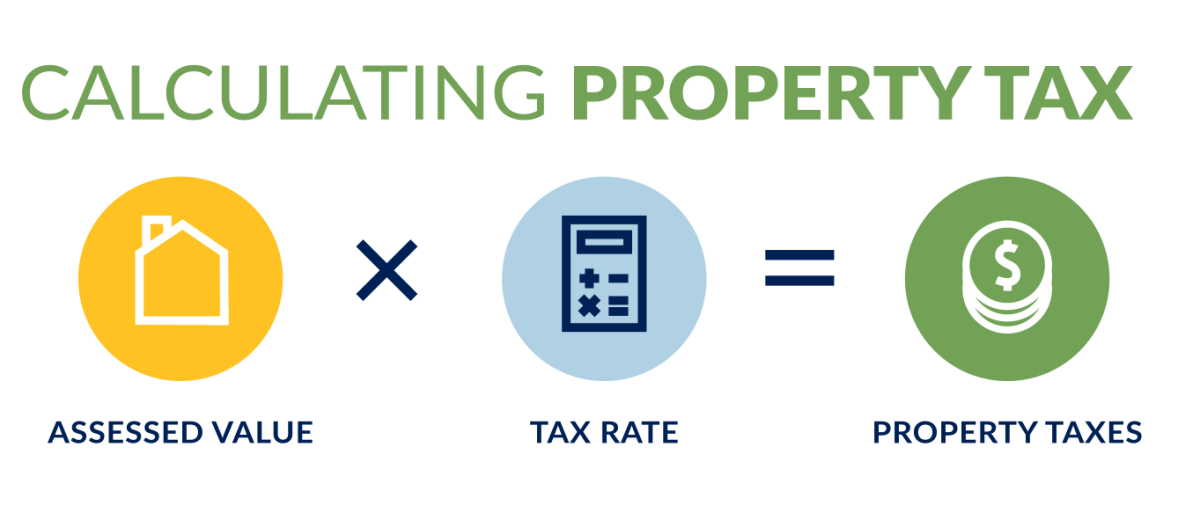

The resulting tax effect on assessment differences is minor as tax rates are very low relative to value. For illustration of tax influence on a 10% assessment range consider the following example:

$500,000 assessment x 0.75% tax rate = $3,750 tax

Change by 10% difference

Compare $550,000 assessment x 0.75% tax rate = $4,125 tax

10% Difference $375 per year or $31/month

A 5% difference equates to $188 per year or $16/month

10. How are sizes calculated?

Sizes come from original building construction plans and are reviewed or updated with periodic update inspections.

11. How are lot sizes calculated?

Lot sizes come from plans of subdivisions registered at the Land Titles Registry.

12. How are assessed values kept fair and reasonable?

Assessed values are determined based on comparisons made of each property’s characteristics to similar properties which have sold.

13. How do renovations or additions affect my assessment?

Assessment is based on typical market value, so any significant changes such as additions or garages that influence value will affect assessment.

14. How many properties are assessed each year in Okotoks?

Over 12,000 properties assessed each year.

15. I purchased my property very close to the effective valuation date so how can my assessment be higher?

Some assessments will be higher and some will be lower, but on average the median assessment is expected to be on the median sale price of similar properties. A lower purchase price at time of the effective date of the assessment may indicate a good buy when compared to its competitive group.

Assessment values incorporate mass appraisal methodologies, which use a common valuation approach and data to develop typical valuations. Similar properties will have a range in prices. Sale prices may be at the upper or lower end of the range. A property’s sale price can occur outside the range, but the assessment can still meet legislated standards.

16. I have an appraisal report prepared by a professional independent appraiser who is certified by the Appraisal Institute of Canada, why does their appraisal indicate a lower value?

Check the purpose and function of the report, the effective date of the valuation, interest valued, and limiting conditions regarding use of the report. If those match assessment parameters, with an effective date close to July 1, then it would be appropriate to send a copy of that report to the assessors for discussion.

17. What if my real estate agent thinks the assessment is too high?

Although realtors have access to good sales data through the multiple listing services (MLS), there are a significant number of properties that do not sell through the MLS system and are included in the assessment analysis.

Keep in mind that real estate agents are professional facilitators with vested interests in the wellbeing of their clients. Their role is to represent their clients in purchase and sale agreements to the best of their ability. They are not bound by any assessment standards or appraiser objectivity, responsibilities, tests, or reporting requirements. If you need more information, please refer to the Alberta Real Estate Act.

18. What would cause my assessment to increase more than others in my area?

If there have been no significant improvements to the property such as additions, or garage, etc., an increase greater than the norm indicates the reassessment objective is working. Updated property sale data indicates that market participants are now prepared to pay proportionately more for your property type, and, or, location compared to others.

19. Why has my assessment increased when general market decreased?

There are a number of factors that go into determining assessed values. A variety of changes including extensive renovations, basement development, garages, additions, fireplaces, etc. can alter assessed value.

The assessed value is determined through an analysis of properties that have sold. Different neighborhoods or dwelling types may appreciate or depreciate in value at different rates year to year.

20. Why is my property assessment higher than my neighbours? Consider:

- Are both properties similar in type (two story vs bungalow)?

- Are they the same size?

- Are the lot sizes similar?

- Are there location or amenity differences?

- Are they similar in age or have there been additions, renovations?

- Do both properties have garages or basement development?

- Does the neighbor border main traffic corridor?

- Any or all of these factors can influence assessed values

21. Does an annual assessment system create a disincentive for improving my property? No it doesn't, and this is why:

- The ratio of tax to value is extremely low; typically around 1 per cent.

- Many improvements will not increase the assessed value.

- It takes a great deal of capital expenditure to increase an assessed value.

- The improvements must be significant to that of adding space or increasing the building class.

- The cost of making improvements to existing buildings will not add proportionately dollar for dollar to assessment value, as the assessment is based on comparisons of sale prices of similar property.

22. Is there notice of residential property inspections?

Yes, Section 294 of the Municipal Government Act indicates that assessors have the right to enter and inspect property for the purpose of preparing an assessment after providing notice (assessors will have Town identification). Properties are inspected on five year cycles.

Assessors collect data from inspections, plants, permits, property owners, land titles office, listing services, etc. in preparing assessments.

If residents are not home and more information is required, a call-back card may be left to make an appointment. Assessors will continue property inspections throughout the year. For more information, contact an Assessor using the contact information at the bottom of the webpage.